Summary:

Net worth is out; net fulfillment is in. Legendary energy trader Bill Perkins realized early on that it makes exactly zero sense working to make money that you'll never spend or enjoy, and that what matters most in life is to maximize your fulfillment from experiences, not stacking up wads of cash that you'll be too old and sick to spend.

He suggests optimizing for memories, fulfillment, and peak experiences, rather than wealth for its own sake. It's a delicate balance - planning exactly how you will spend your time and money to achieve the highest possible life satisfaction you can with the resources you have available.

One of your most important resources is, of course, your health, and once that dips below a certain level, it doesn't matter how much money you have - your capacity to enjoy life to the fullest will be crippled, and you'll be saddled with regret for the risks you could have taken, the memories you could have made.

Essentially, the book is about maximizing your life experiences, which means balancing time, money, and health, throughout your lifespan. Sometimes, it absolutely makes sense to trade time for money, but ruining your health for the sake of money is usually a horrible investment!

Sometimes, it absolutely makes sense to buy back your time by paying people to perform tasks that you don't enjoy - such as yard work - but at other times, you'd be better off saving the money and doing the work yourself. Whatever your unique situation, you don't want to get to the end of your life and realize that you've never really lived.

As Perkins explains in the book, for heads of households between the ages of 70 and 74 (in America, and at the time of writing), the median net worth is $225,390. One's seventies, for many people, is sadly too late to enjoy many of life's most fulfilling experiences.

We all know how important money is to our well-being and happiness, but many of us work too hard at jobs we hate to make money that we may never get to spend! That’s crazy! At the end of our lives, all we have are our memories, and as Perkins notes, these memories pay dividends every time we look back on them!

Whenever you make a memory, you now have the ability to re-experience whichever feelings and emotions that original experience inspired, and you can do this every single time you look back on that memory. It pays dividends over the course of your life, every time you re-experience those memories!

So, it usually makes sense to spend money on unforgettable experiences, regardless of whether you can “afford” them at the time. Before we die, none of us will ever regret not spending more time at the office, but we will regret all those priceless memories we never formed, and all those bold leaps we never took.

To be fair, Bill Perkins is a professional investor and the types of experiences he writes about in the book may be beyond the reach of many people reading it. But that's not a reason not to read it. And it's not a reason to avoid thinking about how to maximize your life satisfaction using the resources you do have available to you. You don't have to die with literally zero dollars in your bank account as Perkins is aiming to do, either. These ideas of his are cattle prods to get you thinking in diverse ways and to help you reimagine what your life could be.

Speaking for myself, some of the best times of my life were next to free! Come to think of it, most of my happiest memories were made while working at a bar as a bouncer. Nobody ever believes me when I say that, but for me, it was the perfect job to take! So, essentially, I got paid to create memories! If you get creative, you can create spectacular memories of your own, no matter what your financial situation.

The larger point for young people with too much "month" left at the end of their money is that they should avoid - at all costs - the situation of having too much money - and too few memories - at the end of their lives.

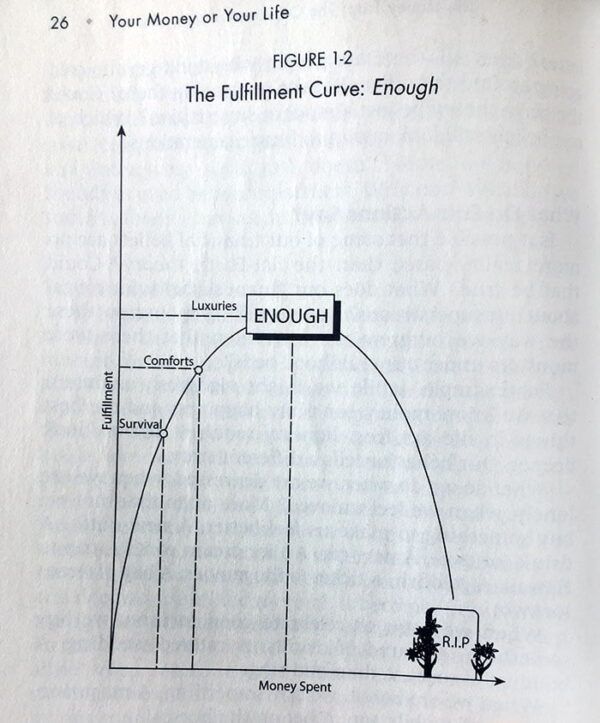

Perkins also draws heavily from a concept detailed in the book, Your Money or Your Life, by Vicki Robin and Joe Dominguez, called the "fulfillment curve."

Looking at the curve in the chart above, you can see that above a certain level of spending, anything more than that is at the very least wasteful, and even potentially damaging to happiness and fulfillment. One of the ways it relates to Die with Zero is that after a certain level of wealth is reached, making more money won't make you any happier; you have to spend it in order to derive any of the happiness benefits that it could confer.

Again, it's all about balancing those three key resources: time, health, and money. Sometimes it makes sense to trade your time for money, and at other times it makes sense to do the opposite, like paying someone else to get you out of doing the things from which you don't derive any fulfillment. In the latter case, you're buying back your time.

At the end of our lives, very little remains; but the last things you'll ever possess are your memories. It's extremely worthwhile to spend some time now to figure out how to build a life you'd be proud to look back on.

There are tons of great concepts in this book, from memory dividends, time buckets, and personal interest rates, etc. But what it's really about is taking your own life more seriously; or, if not more seriously, then absolutely more sincerely, as Alan Watts would say.

Time moves only in one direction, and if we don't use what time we have available to free ourselves, it will be gone and never return. I'm not that profound - I stole that last sentence from Marcus Aurelius - but the point still stands. There will come a time when there is no more time. Your life will have been your life, your choices will have been made, your future fixed, and your memories set - for better or for worse.

Aging is a reality to embrace for the unique joys that it can bring us, and we can do so with dignity and grace. But before we get there, we stand at a unique crossroads: what we do now echoes in eternity (Marcus Aurelius again, I'm sorry), and what we do now determines the options that are available to us in the future - we make the path by walking.

Our choices today - our effectiveness at maximizing our time, our money, and our health - shape our possibilities later on in life, and if we're sincere about making this life everything it could be, today's the day to make it happen.

Key Ideas:

#1: “Squandering our lives should be a much greater worry than squandering our money.”

The Roman statesman Seneca observed thousands of years ago how strange it was that people take great care to manage and maintain their money, but are so quick to throw away their time.

I've said this many times - sometimes literally shaking people by the shoulders as I'm telling them - but it's also just so critical to understand: you will never, ever get any of your time back. You can almost always make more money, but you will never be able to make more time! So if you realize how valuable your time is, you see also that you have to protect it.

Yes, manage and protect your money too. It's important. But Die with Zero is about avoiding the fate that befalls too many in our hyper-productive, consumerist society: getting to the end of your life and realizing that you could have been so much happier; realizing that you accepted a cheap imitation of life, and actually forgot to live.

#2: “Maximizing your fulfillment from experiences – by planning how you will spend your time and money to achieve the biggest peaks you can with the resources you have – is how you maximize your life.”

This is the core of the book right here. It's about maximizing fulfillment rather than net worth; optimizing for sensational life experiences and fantastic memories, rather than a fat bank account that you'll be too old and sick to access.

This takes careful planning and real thought to achieve. It's not impossible, but it's also not very likely to happen without intentional action. Bill Perkins advises taking a careful inventory of your available time, health, and money, and seeking to optimize the balance of all three. More on this later.

#3: “In fact, some of these memories, upon repeat reflection, may actually bring more enjoyment than the original experience itself. So buying an experience doesn’t just buy you the experience itself – it also buys you the sum of all the dividends that experience will bring for the rest of your life.”

You retire on your savings, yes, but you also retire on your memories. What you have to look back on will have been your life, and you'll see that your memories can pay you "dividends" just like your investments can.

When you invest in dividend stocks, you get paid dividends several times over the course of the year, in amounts totaling a percentage of the value of the stock. It varies across industries, but the average dividend yield you'll find is usually between 2-5%. So if you hold one stock valued at $100 and it has a 2% dividend yield, you'll get paid out a total of $2 over the course of the year. Some people have entirely replaced their incomes this way. But, for our purposes here, it's important to point out that memories work in almost the exact same way!

When you make a memory, you now have the ability to re-experience whichever feelings and emotions that original experience inspired, and you can do this every single time you look back on that memory. It pays dividends over the course of your life, every time you re-experience those memories!

So as long as you hold onto that memory, you can enrich your life in the present any time you want. Those are memory dividends, and it pays to create amazing, phenomenal memories that result in the largest, most awesome memory dividends every single time you look back on them.

#4: “Think about the three basics people need to have to get the most out of life: health, free time, and money. The problem is that these things rarely all come together at once. Young people tend to have abundant health and a good deal of free time, but they don’t usually have a lot of money.”

Maximizing those three resources - time, money, and health - is how you maximize your life. Perkins is right, though, in that they don't usually arrive all at once, and it takes deliberate, focused thought in order to cultivate them optimally.

Knowing this is half the battle. You're already well on your way to doing something about it, and, depending on your situation, you can make the choice to focus more on your health, buy back more of your time, or spend some of your time and health in order to make more money.

Again, it all depends on which season of life you're in. If you're 90 years old with millions in the bank and next-to-zero expenses, it makes absolutely no sense to sacrifice more of your time and health to amass more cash.

But, if you're in your early twenties and broke, it can make total sense to spend some time, and to push yourself a little bit - which can take a toll on your health - to stack up some extra cash to spend on spectacular experiences in your thirties and beyond. It's all up to you. Be smart about it, weigh your options, and then act on your choice.

#5: “Just realize that time moves in only one direction and that as it passes it sweeps away opportunities for certain experiences forever. If you keep that in mind as you plan your future, you’ll be more likely to make the best use of every year of time in your life.”

There are certain activities that you'll only be able to do while you're young, and, if you don't do them then, you'll miss out on those activities forever. If you keep waiting, and waiting, and putting them off, and then waiting some more, there will come a time when you just won't be able to do what you've always dreamed of doing.

The idea of "time buckets" fits in well here. If you think of your twenties, thirties - basically every decade of your life - as a distinct bucket or unit, you can give some thought as to what you'd like to fill each bucket with and make sure you do that as you get older. Backpacking across Europe is likely to go into the "20s" bucket, whereas dining at Michelin star restaurants can be done at almost any age.

Having these buckets all laid out can also help you can plan, seeing as you'll know exactly when you plan on doing certain things and how much you'll need to have saved up in order to squeeze as much fulfillment as you can out of each experience.

If you're in your twenties now and you know that your thirties is when you'll have to cross the Sahara desert or potentially give up on that experience forever, you'll be able to see exactly what you need to do now in order to make that happen. You can start looking at flights, learning how to survive in the desert, working on your cardio conditioning, etc.

Likewise, if you'd love to be able to take a cruise eventually, you can see that you'll still be able to enjoy that experience in your fifties, and you have 20+ years during which to save up whatever amount of money it'll cost you to get the absolute most out of that experience.

#6: There’s absolutely no point working at something you hate just so you can save money for experiences you’ll never have. If you get to the end of your life with a ton of extra cash and nothing to spend it on, you'll basically have worked for that money for free. If you're not gonna spend it, why did you work for it?

Now, I will also take the time to point out here that your daily work can be a great experience! You can make fantastic memories at work, as in the rest of your life, and your job or career doesn't have to be just this drudgery that's totally separate from the rest of your life where you do your "real" living. Work can be fun. It can be uplifting. It can bring out your fullest potentialities as a human being...or it can be something you just"get through" on your way to building a real life.

I will never pretend that everyone's work can be joy, or that everyone has the potential to do work they love. That's just not an economic reality in what is, today, in many ways a primitive culture. There are many more opportunities available today than there ever have been in the entire history of the world, but too many people face too many challenges, and bear too many burdens, for me ever to be able to say, "Just go out and find your passion!" Our world is more complicated than that.

Some people just have to pay the bills; and if that's your reality, embrace it with dignity, grace, and courage. But it might not be your reality, that's what I'm saying. Maybe there's something potentially or actually wonderful about your job that you're not fully appreciating. Most jobs contain at least something enjoyable, worthwhile, and memorable; and most importantly...whatever you choose to do, don't work more than you have to in order to reach the peak of the fulfillment curve!

#7: Making mistakes early in life - especially financial mistakes - doesn't hurt you nearly as much as making those same mistakes when you're older. If you make a bad investment in your twenties and you lose $1,000,000, that still sucks, but you have your entire life to make that money back. If you're ninety and you squander a million dollars that you can't afford to lose, that's gonna sting. You may not be able to recover from that.

This applies to every kind of mistake, of course, from deciding who to marry to choosing what to study at college. Dating in your fifties is much harder than it is in your twenties, and if you realize that you "wasted" ten years on a medical degree and you actually hate the reality of being a doctor, it's much easier to switch careers in your thirties or forties than it will be later on.

The corollary to all this, of course, is that you should take more risks when you're younger, and be more conservative with risks as you get older. Take calculated risks, but realize that now is the time to make them, not when you can't afford to take the potential loss.

#8: Accepting and making peace with a negative experience can actually be a positive experience. This wasn't technically in the book, but it's worth pointing out, since we're trying to maximize our fulfillment from experiences here. Die with Zero is about crafting a life filled to the brim with positive experiences, and to do that, you don't need to run away from every negative experience.

The flipside to all this is that wanting a positive experience is actually a negative experience, because you're experiencing lack, frustration, and unfulfilled desire in the present moment. Wanting something you don't have is an awfully negative experience.

Dragging yourself through each day, just going around wanting stuff isn't a recipe for fulfillment; but if you can learn to rise to the level of your challenges and trials, your experience in that moment is one of self-respect, pride, and grace. A difficult life that you stand up to unafraid is better than an easy life that doesn't call upon any of your highest potentials.

#9: Your “personal interest rate” is the amount that someone would have to pay you to delay having an experience that you could have now. Rationally, they would have to pay you more as you get older, since you won’t have as much time or health to enjoy the experience.

This basically means that money loses value as you get older, whereas time and health gain value, because they're both slowly running out. When you're young, you have plenty of time and health (ideally) and it may not be a bad idea to trade some of that time and health for money. But as you get older, the amount of money that someone would have to pay you would go up, as your time and health get more scarce.

In real numbers, let's say that you were planning on taking a vacation to Greece, but someone offered to pay you $1,000 not to go - because of a job opportunity that conflicts with your travel schedule or whatever.

If you're 25 years old, maybe you can delay that vacation another year or two and just go another time, staying at home to work for that extra $1,000. That might not be such a bad deal. But if you're 50 years old, that dollar figure might not be enough for you. Your years of being able to maximize your fulfillment from travel are constantly dwindling, and maybe you decide that you'd only delay that vacation if you could earn an extra $15,000 or more by staying home. That's your personal interest rate.

#10: “The optimal balance between spending and saving is not obvious at all.”

Everything we've been discussing so far requires conscious, deliberate thought, and the right answers are rarely in plain sight. People are different. Situations vary across individuals, across time periods, and across cultures, and what's right for you may not be right for me. We each have to make these decisions for ourselves.

Nuanced, critical thought is so important when it comes to crafting a life that you can't wait to live, and we have to work out the answers that make sense to us. We have to "live the questions," and someday we'll live our way into the answers.

Book Notes:

“Most of us go through life as if we had all the time in the world.”

“I had been using my savings account totally backward - I was taking money away from my starving younger self to give to my future wealthier self!”

“You’re taking away my life energy and you’re giving me paper!”

Investing in experiences can change your life at any age, whereas financial investments take a lot longer to mature. A great, transformative experience can change the entire trajectory of your life from that very moment onward, whereas in order to realize any significant financial ROI, you'd have to keep your money invested over a time span of many years.

Start investing in experiences early! Do it now! Do it today!

Enhance your memory dividends by taking more photos, reminiscing more often, sharing your stories with others, etc. Your memories pay "dividends" every time you look back on them, enriching your life as you relive those experiences in your mind. So relive them as often as you can, and increase the intensity of those memories so that you maximize your dividend return.

“A higher salary doesn’t always mean more actual income on an hourly basis. For example, a person making $40,000 per year might actually be making more per hour than someone earning $70,000 per year. How is that possible? Again, it’s all about life energy.

If the $70,000 job costs you more in terms of your life energy – the cost in time of a long commute to the city, the cost of the kinds of clothes you need for this high-status job, and of course the extra hours you have to put into the job itself – then the person making the higher salary often comes out poorer in the end.

This supposedly high earner also has less time left to enjoy the money he or she is earning. So when you’re comparing jobs, you really have to factor in those hidden but essential costs.”

If you work to earn money that you never spend, that means that you end up working for free.

“The premise of this book is that you should be focusing on maximizing your life enjoyment rather than on maximizing your wealth.”

“This kind of blanket denial explains why so many people are willing to spend tens or even hundreds of thousands of dollars to prolong life for just a few more weeks. Think about it: That’s money that they spent years or decades working hard for. They gave up years of their life while healthy and vibrant to buy a few extra weeks of life when they are sick and immobile. If that’s not irrational, I don’t know what is!”

“You’d better spend the money while you still have the health.”

“People of all ages should be spending more time and money on their health.”

“How quickly you get tired on a day of sightseeing, snowboarding, or playing with little kids will have an obvious impact on how much enjoyment you get out of that day. Now multiply that out to all your future potential days of such experiences!”

“Better health doesn’t just give you a better retirement years from now – investing in your health is investing in every single subsequent experience!”

“If you pay to get out of doing tasks you don’t enjoy, you are simultaneously reducing the number of negative life experiences and increasing the number of positive life experiences (for which you now have more time). How can that not make you happier with your life?”

Ask yourself, Would I rather have one “Experience XYZ” right now, or wait a bit and have two such experiences later? Bear in mind that waiting might or might not improve the quality of that experience.

You can wait until you have more money to spend in Vegas, for example, thus probably enjoying yourself even more while you're there, but waiting too long would mean that you wouldn’t be young enough to have the kind of fun you could have had.

“What’s easy shouldn’t determine what you do.”

“Even experiences that don’t end the way you’d hoped can still yield positive memory dividends. So being bold is an investment in your future happiness.”

“People are more afraid of running out of money than wasting their lives, and that’s got to switch.”

Action Steps:

So you've finished reading the book. What do you do now?

#1: Quantify your time, your health, and your money.

The best way to manage your time is to track how you're spending it now. The same applies to your money and even your health, since it's far easier to optimize both of those resources if you have a somewhat accurate picture of your starting point.

I don't have the space to go into this in-depth here, but there are a few obvious starting points. For your time, you could dedicate a day or even a week to writing down exactly what you're doing during that time. Every hour so, think back to what you did in the last hour and write it down. At the end of the day or week, you'll have a much better idea of where your time is going, and you can then optimize from there.

When it comes to your money, that one's relatively straightforward too. You just want to have a generally accurate picture of your current financial situation, so you can take a look at it to see where you can make adjustments. I know, everyone keeps telling you to make a budget, but it works! Personally, I track every single expense (rounding to the nearest dollar), and every single stream of income. Every time I make or spend money, it gets tracked. Once you get in the habit of doing this, then you can make intelligent changes based on your discoveries.

Health is much more complicated, but if you can afford it, it's definitely worth getting a complete medical checkup and talking to the physician about what you can do to become healthier and more resilient. It can be painful to take an honest look at your physical health, your financial health, and your time health, but the insights and knowledge you gain by doing so are simply immense.

#2: Don't wait. Live now!

You don't need to spend thousands of dollars to have a good time. You don't need a complete roadmap of your future before you take one single concrete step toward it. You don't need to know everything about investing to open up a brokerage account and buy one stock. Just take the next, smallest, most immediate action, and commit to improving over time.

Many of the greatest experiences of your life won't cost anything at all, and this is because what usually makes an experience spectacular is the people you share it with. You think everyone knows this? That it's common knowledge? Sure, but are you doing it? Are you making phenomenal memories now, or are waiting for some mythical "later" that may never arrive?

With everything I just mentioned, it's so easy to think that you'll just get to it "someday," that it'll be a problem for "Future Homer" (man, I don't envy that guy!). But you can have your dream life today. Or at least part of it. Something of your dream life can show up today; you can experience a tiny sliver of paradise today, and it doesn't have to cost a lot of money.

So think about some ways that you could start living the life you've always imagined, and living it now, today, immediately. Take steps to secure your future, yes, but also take massive action to make sure you don't miss out on today.

#3: Make plans with three friends.

Your greatest memories will likely involve other people. They'll be memories of parties, great loves, wild adventures, impossible odds, daring risks, and quiet moments of mutual care and affection. Your friends will show up in most of your memories, so get busy creating those memories today.

This Action Step is easy: Pick three of your friends and make plans with each of them (together or separately) this week, and commit to following through no matter what. If you're separated by distance or by pandemic, get on Skype or Zoom. It hardly matters. Just involve them in your memories, and make sure they know how much you value their friendship.

#4: Take more photos.

I wish I had taken more pictures. In Russia, India, Costa Rica, everywhere else...it's almost shameful how few pictures I've taken. To my mind, it was always that if you're taking pictures, you're not "in the moment," and that's true to some extent, but it's not an either/or proposition! You can do both.

Strike a balance between deeply immersing yourself in the experience, and taking a step back to appreciate it, taking photos that you'll be able to look at later. Having pictures to look at calls up more vivid memories, and even reminds you of things and events and people that you would have forgotten about otherwise.

So take it from me: you're going to regret not taking more pictures. Today, I make sure that at least someone from my group has their camera out, and that I snap a few myself to post later. I'm still enjoying myself in the moment, I'm still present, but I make sure to have "memory retrieval devices" (photos) available for later.

#5: Calculate the total cost of your dream experiences.

How much do your biggest dreams actually cost? Have you ever done the number-crunching necessary to find out? I think that a lot of your results may surprise you. Spectacular memories and world-class experiences often cost much less than you'd think.

For one thing, you can buy a plane ticket to almost anywhere in the world for less than $1,500. Sometimes considerably less. With Airbnb and cheap accommodations everywhere, cooking your own food, etc., you can travel the world for an entire year and spend around $20,000. A lot of money? Yea, to most people. But remember, you'll remember this glorious year for the rest of your life.

Let's break it down:

Plane Ticket - $1,500

Airbnb - $500/mth for 12 months = $6,000

Food - $500/mth for 12 months = $6,000

Other Travel - $2,000

Sightseeing - $5,000

TOTAL: $20,500

This is just one example, but I could give literally thousands more. Sure, you could spend more or less in any of those categories, certainly, but if all you want to do is travel and make friends in exotic locales, you don't need a million dollars. You don't even need $100,000! Nowhere even close to that!

Do you want to fly in a private jet? Don't buy one like a sucker; rent one! They cost like $2,000 per flight hour. So if you live in the U.S. and you want to travel from New York to Vegas in a private jet, it'll "only" cost you $10,000. Yes, it's a lot of money to most people, but it's not outside the bounds of possibility.

You now have a fantastic memory of one of the greatest weeks of your life - that you can now look back on every day of your life if you want - and it only cost you $10k, plus whatever Vegas took out of you.

Do these calculations for every single experience you want to have, and you'll start to realize that it costs far less money than you think it will. These real numbers will fire up the engines of your imagination, and from there anything is possible.

#6: Make a list of risks, experiences, and contributions.

This fits in with what we were talking about above, and it helps also to place these dream experiences inside their relative "buckets," which we talked about earlier too. I recommend writing them out where you can see them, and where they will motivate you every day.

I've even heard of people making a wall chart detailing the experiences they'd like to have in the future. Divide the chart into buckets, or time periods, starting from whatever age you are now, and fill them in based on which season of life is most appropriate for each activity.

So, if you're in your thirties, make a list of everything you want to do - and can do - in your thirties, and then a separate list for your forties, etc. You'll be reminded of your goals every day, you'll know exactly what's coming up that you need to prepare for, and you'll also be inspired to turn those dreams into memories.

#7: Distribute your wealth earlier.

What about charitable contributions? Your kids, if you have any? When will they see any of this money? Well, there are a few considerations to make here.

First, there are children under the age of five years old starving to death every single day, all over the world. I'm not trying to make anyone feel guilty, but, that's the reality. Why wait until you're dead to give your money to the charities that could help feed them?

It's the same thing with your kids. Perkins makes the point that when your kids are older, they're probably going to be more settled financially anyway. They don't need your inheritance money when they're fifty; when they could really use it is in their twenties and thirties!

Assuming you've taught your children sound financial principles and solid spending habits, they're going to be in a position to benefit from the money you've planned to give them earlier rather than later. In their twenties and thirties, they're going to school, building businesses, starting families, developing themselves...that's when they could use your financial support!

There's also a counter-argument to be made here that if you leave your money sitting in your investment accounts, then that money will grow via compound interest and likely be much more valuable later. Giving your kids $10,000 now, if that's all you have, might or might not be preferable to giving them $1,000,000 when they're 65 or 70.

So again, these are decisions that you have to make yourself. Few books can provide the perfect answer for every situation. All that most books can do is alert us to the existence of the questions.

About the Author:

Bill Perkins is one of the world's most successful hedge fund managers and entrepreneurs. After studying electrical engineering at the University of Iowa, Bill trained on Wall Street and later moved to Houston, TX where he made a fortune as an energy trader. Perkins is currently the CEO of BrisaMax Holdings, a consulting services firm based in the U.S. Virgin Islands.

Now at age 52, Bill views his career as an engine for personal growth and spends his time exploring the world, savoring his relationships, and taking in all that life has to offer.

Die with Zero is a labor of love project. Bill has been developing the principles outlined in the book since his first job making $16,000 a year in the '90s as a screen clerk for the New York Mercantile Exchange.

Additional Resources:

Perkins on the Raise Your Edge Podcast

The Fulfillment Curve - The Best Interest

This Book on Amazon:

Die with Zero, by Bill Perkins

If You Liked This Book:

The Psychology of Money, by Morgan Housel

Your Money or Your Life, by Vicki Robin and Joe Dominguez

The Subtle Art of Not Giving a Fuck, by Mark Manson

The Millionaire Fastlane, by M.J. DeMarco